Europe: Opportunity or Trap?

Mike Wilson, Joe Peta, Ozempic, China Concerns, Wealth Trends & More

“A pessimist complains about the noise when opportunity knocks.”

— Oscar Wilde

Research

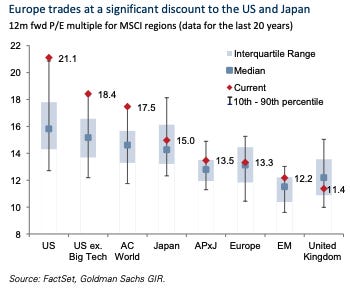

Goldman Sachs - How Investable is Europe? (32 pages)

Goldman assesses whether Europe’s cyclical, political, and structural challenges are priced in.

Note: 60% of European companies are now buying back shares, compared to around 20% historically.

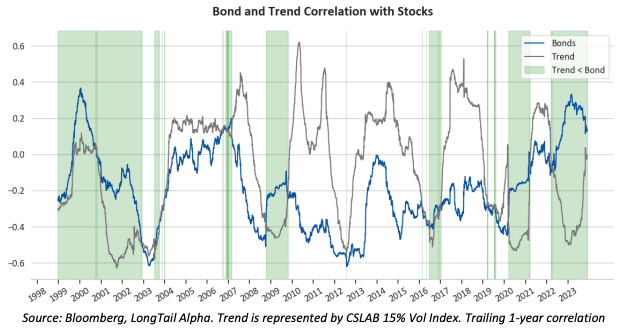

LongTail Alpha - Risk Parity with Trend Following (17 pages)

Risk-parity strategies excelled from the early 1990s through 2020, benefiting from a negative correlation between stocks and bonds, positive returns from both asset classes, and an environment of falling interest rates. What if you replace or augment the bond allocation with trend-following?

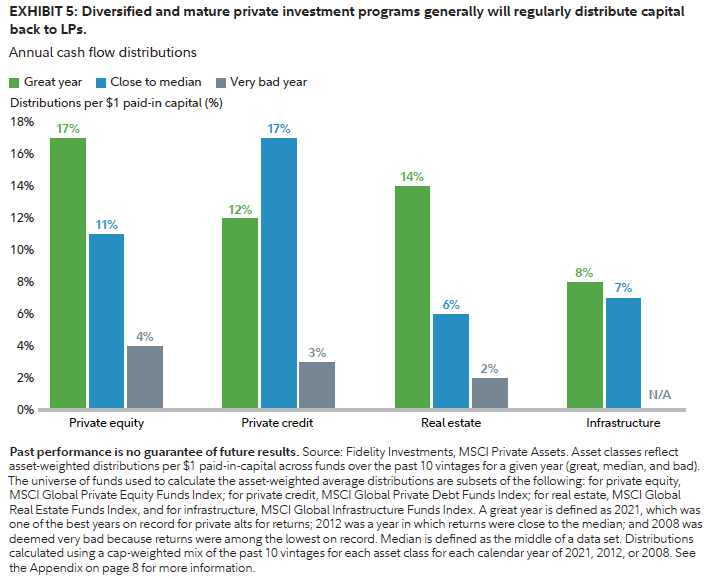

Fidelity’s analysis shows nonprofits can potentially both improve investment performance and reduce spending volatility by accessing above-median private market managers.

Facts & Figures

Novo’s sales of Ozempic and Wegovy are on track to hit $65 billion by the end of 2024, which will surpass the drugmaker’s entire research budget for the past 3 decades, after adjusting for inflation. Link

Of the roughly 8,000 listed China-based companies, only about 600 have made an average return on capital of more than 10% over the last five years. Link

The share of mortgage-free U.S. homeowners just hit a new high of 39.8%. Link

According to the Charles Schwab Modern Wealth survey, Americans believe it takes a net worth of $2.5 million to be considered wealthy in 2024, a 14% jump from last year. Link

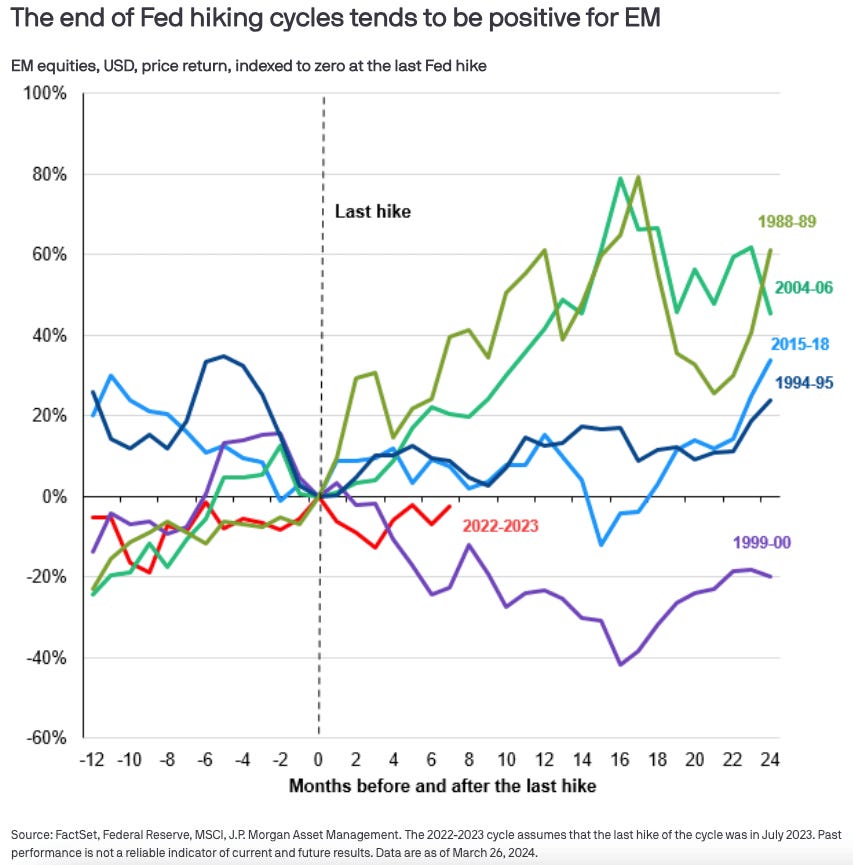

Since 1988, EM equities have delivered positive performance 24 months after the last Fed rate hike in four of the past five Fed rate cycles.

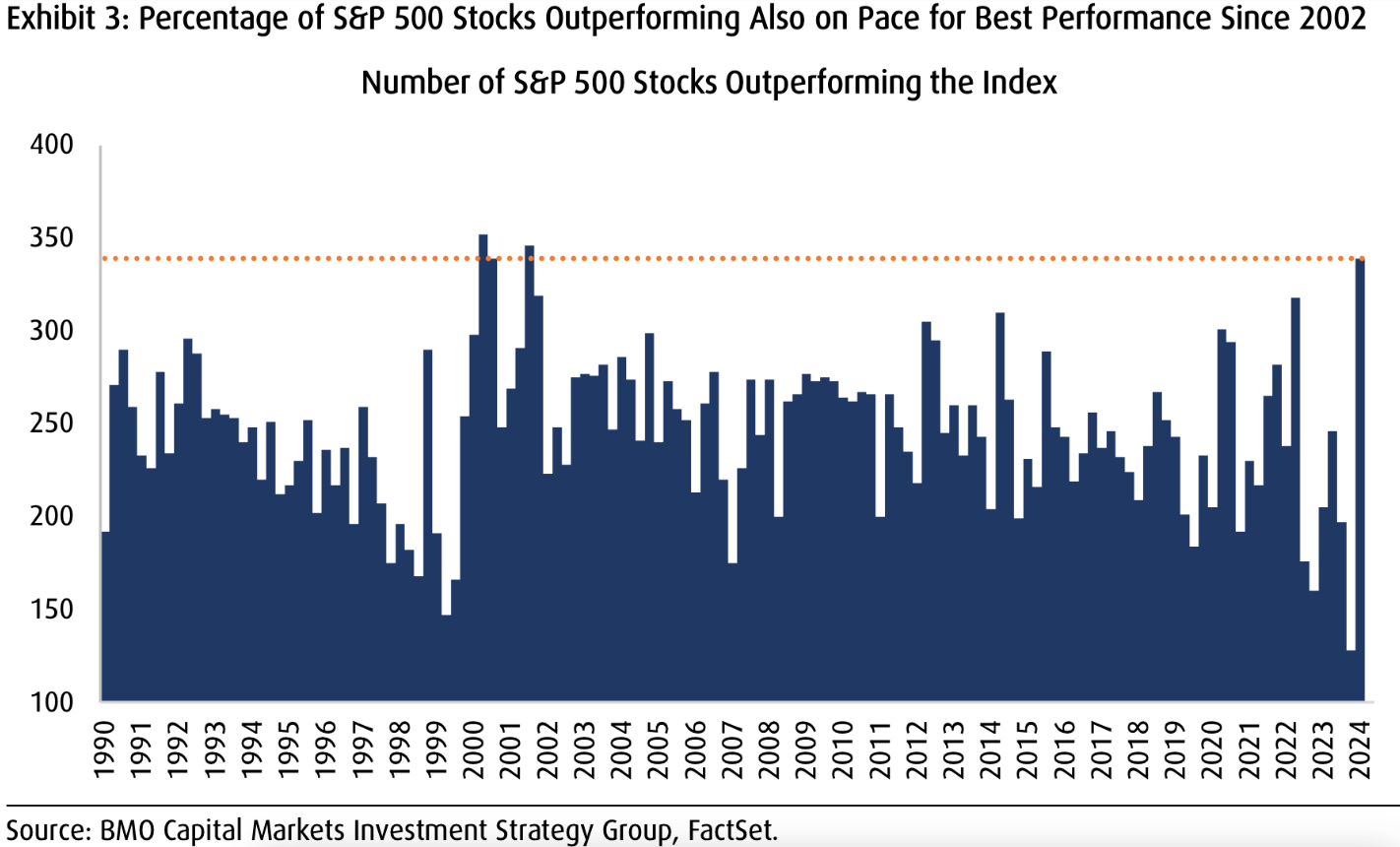

After low participation to start the year, participation is set to finish the year at the highest levels in almost 22 years.

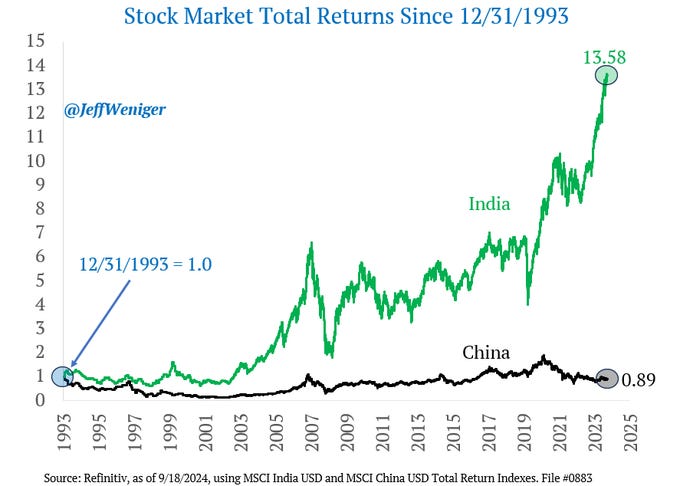

Since 1993, the total return on Chinese stocks is negative, while India is a 13-bagger. Link

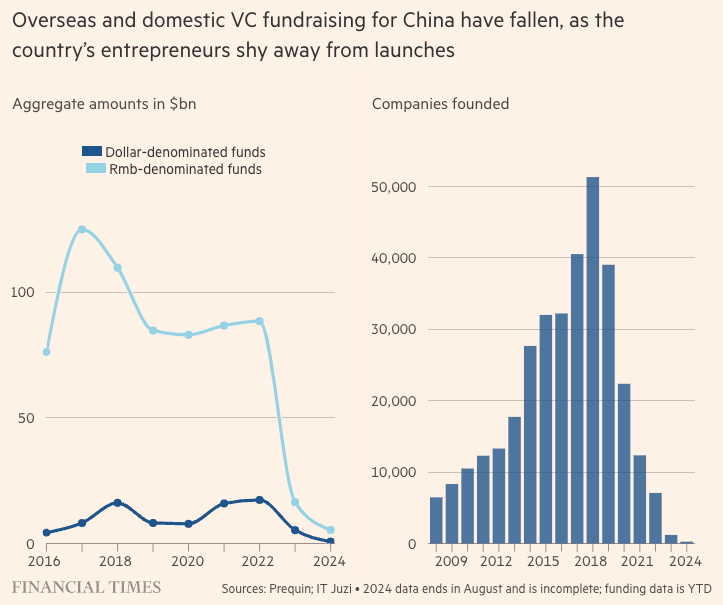

The VC & startup landscape in China has seen a huge decline. Link

Podcasts

On the Tape: Let The Market Bounce & Save Our Souls with Mike Wilson: Mike Wilson recent economic developments, the evolving AI technology landscape and the performance of quality defensive stocks, energy and industrial stocks amidst late-cycle trends. [9/12/2024 - 50 minutes] Apple | Spotify | YouTube

The Odd Lots: How Hedge Funds Discover the Next Superstar Trader: Joe Peta, who was previously the head of performance analytics at Point72, gives a masterclass on performance measurement and best practices when evaluating portfolio managers.[9/5/24- 55 minutes] Apple | Spotify | YouTube

What Else Is Happening

Did you miss last week’s email?