⚠️ The Private Equity Market Has Stalled

Jeremy Grantham, Liz Ann Sonders, BOXX, Michael Green, Steve Edmundson & More!

“Bulls make more than bears, so if anything, being an optimist about life and about things in general is a great attribute as an investor. You just can’t be starry-eyed and naive.”

—Stanley Druckenmiller

Research

GMO - The Great Paradox of the U.S. Market (6 pages)

Jeremy Grantham’s latest piece digs into the U.S. stock market, bubbles and AI, real assets, and underrecognized long-term problems.

"The most expensive 20% of U.S. stocks are by definition always expensive, but today they are in the worst 10% of their 40-year range (compared to the top 1000 stocks). In great contrast, the cheapest 20% are in the best 7% of their range."

—Jeremy Grantham

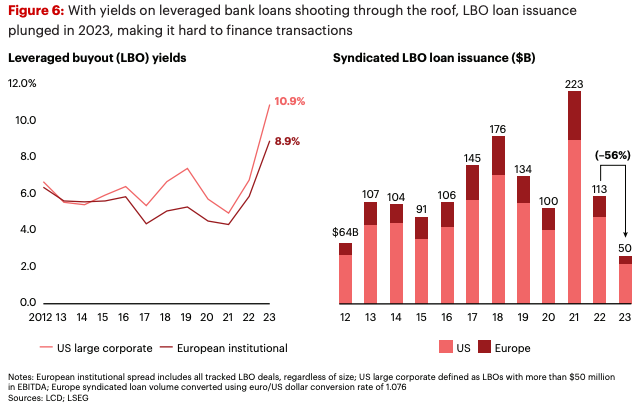

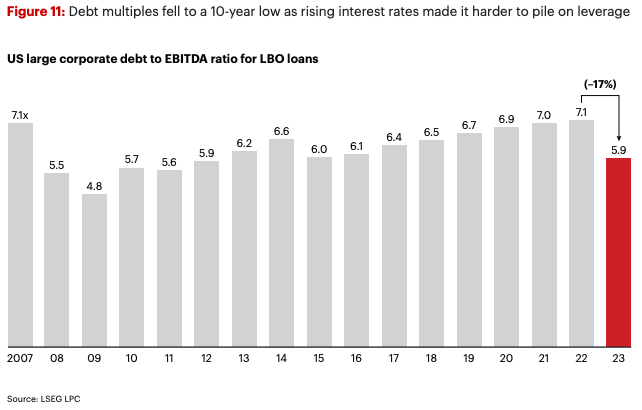

Bain & Company - Global Private Equity Report 2024 (60 pages)

Bain describes private equity as a market that’s ‘stalled’ due to a rise in interest rates. The report walks through current investments, returns, exits, fund-raising and more. Some stats:

The total value of companies that the industry sold privately or on public markets declined by 44% (lowest in a decade)

Deal value fell by 37%

Exit value declined by 44%

38% fewer buyout funds closed

The value of aging unexited companies hit a record high $3.2 trillion

Facts & Figures

Stanley Black & Decker has paid a dividend for 147 consecutive years, longer than any other industrial company on the NYSE. Link

An alien CryptoPunk sold for 4,850 ETH (US$16.42 million) in March, the second highest sale price in the history of the preeminent digital art collection. Link

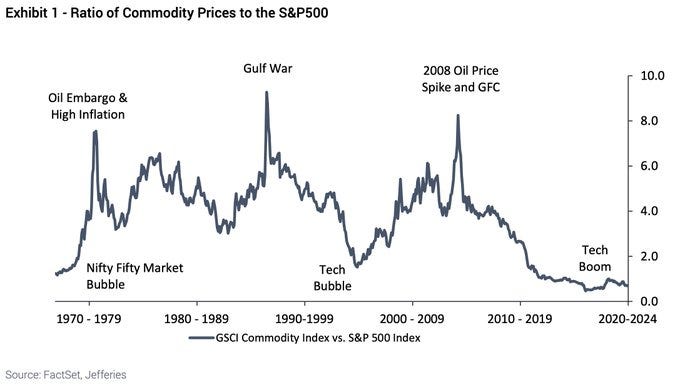

The ratio of commodity prices to the S&P 500 is near all-time lows. Link

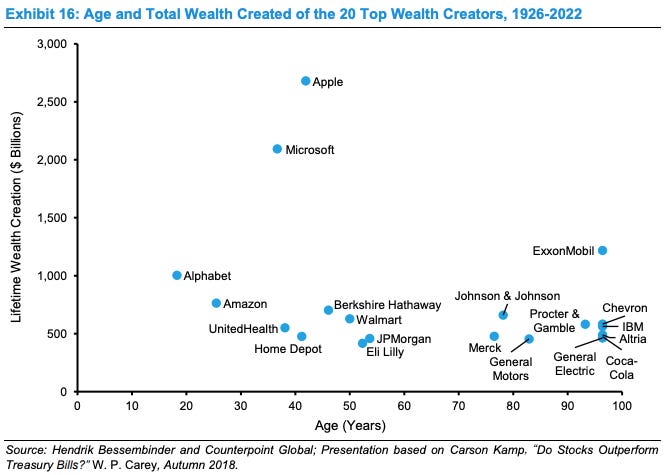

Apple has created ~$2.7 trillion in wealth from its IPO in 1981 to the end of 2022, more than any other company. During that same time period, Apple suffered three drawdowns of 70% or more. Link

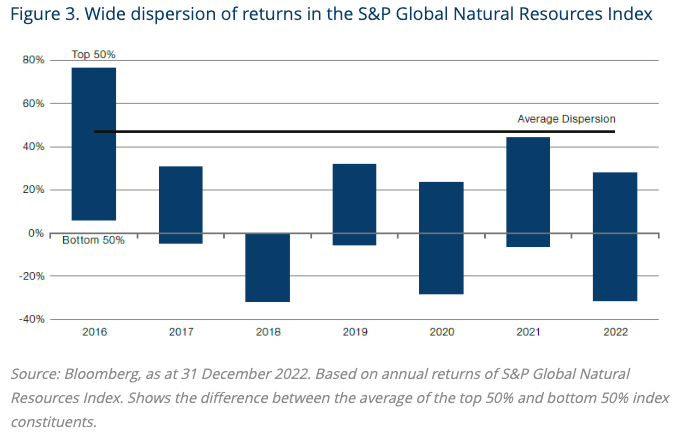

For natural resource equities, the average dispersion (measured by the average performance in the top 50% versus the bottom 50%) is close to 50%. Link

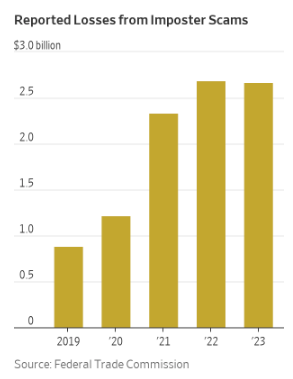

“The Federal Trade Commission, which polices deceptive business practices in the U.S., says reported impostor scam losses tripled between 2019 and 2023 to $2.7 billion.” Link

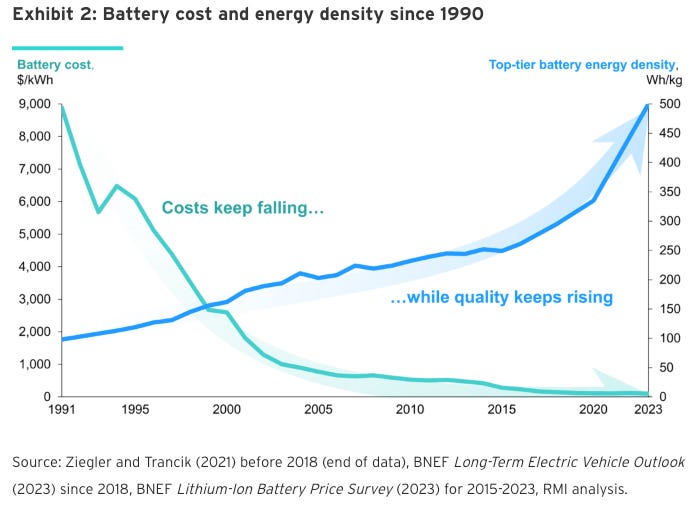

“Over the past 30 years, battery costs have fallen by a dramatic 99 percent; meanwhile, the density of top-tier cells has risen fivefold.” Link

Podcasts

Forward Guidance: Liz Ann Sonders: There's No Such Thing As A Typical Interest Rate Cutting Cycle: Liz Ann Sonders shares her investment and economic outlook for the U.S. [3/12/2024 - 58 minutes] Apple | Spotify | YouTube

The Phil Bak Podcast: Michael Green: Broken Markets: Phil Bak & Mike Green talk about the over-emphasis of indexing, passive investment, the reduced reward for conducting fundamental analysis, and more. [3/12/2024 - 45 minutes] Apple | Spotify | YouTube

The Business Brew: Quick Drop: Wes Gray: Alpha Architect’s Wes Gray talks about the BOXX ETF, how he helps people start their own ETFs, why value & momentum work as factors, & more. [3/2/2024 - 70 minutes] Apple | Spotify | YouTube

What Else Is Happening

Did you miss last week’s email?

Meb Faber spoke with Steve Edmundson about indexing the majority of Nevada PERS’ $60 billion pension.